Imports

IMPORTS:

Follow this link for Duty-Tariff Best Practices and Guidance.

- If you need assistance with customs clearance, determining which duties/tariffs will apply to your product, or other importing questions please reach out to Caltech's designated customs broker Packair Airfreight Inc. for assistance:

- Contacts:

- Cindy Lane(VP Import Operations)

- Email: [email protected]

- Phone: (310) 337-9993 x211

- Jae Kwak

- Email: [email protected]

- Phone: (310) 337-9993

- Roger Bachar

- Email: [email protected]

- Phone: (310) 242-2045

- Cindy Lane(VP Import Operations)

- Contacts:

Caltech has a signed Power of Attorney (POA) on file with a licensed custom broker to authorize custom clearance on behalf of Caltech for shipments entering the United States. Caltech also has an executed "Broker Select" form on file with Federal Express that redirects customs clearance to Packair eliminating the need to file a CBP 5106 form and POA which can be time consuming.

Requests for Power of Attorney signatures from non-approved freight forwarders requires legal review and a corporate officer's signature that can cause your import clearance to be delayed. It is highly recommended that you use approved Caltech broker's instead or work with Procurement to ensure that the import terms including INCO Terms (clearance and carriage instructions, who will responsible for paying duties, etc.,) are properly defined. Please contact the Office of Export Compliance if you need assistance with customs broker questions.

Review the information found here to determine if your shipment is subject to additional requirements. Please also contact the Caltech Environment, Health and Safety Office: [email protected] or x6727.

Importing into the United States Guide

Centers for Disease Control and Prevention

- CDC ([email protected], 404-718-2077)

Shipments into the United States may require an import permit or other documentation such as a CITES certificate, USDA and/or CDC permits depending on the type of goods you wish to import. Foreign countries may also have their own import/export requirements for certain commodities arriving from the U.S. Below is an example, a non-inclusive list, of categories of items that may be subject to additional requirements such as quarantine, permitting, inspection, etc., prior to import:

CHEMICALS, BIOLOGICALS, NUCLEAR materials that may require additional documentation:

- Chemicals

- Genetic elements and genetically modified organisms

- Organisms and vectors

- Plant or animal products and pathogens

- Vaccines, immunotoxins, medical products, diagnostics, etc.

- Organism and Soil

How do I figure out the duty on the item being imported into the U.S.?

Harmonized Tariff Schedule (HTS)- The Harmonized Tariff Schedule (HTS#) contains the harmonized schedule code for customs duties (rate of duty) imposed on your item for entry into the United States. The Harmonized System is used by all countries up to the sixth digit, the last four digits in the HTS# are country specific. Also, the duty rates may differ from one country to another depending on the country of export/import and country of origin (where the item was manufactured, purchased), Free Trade Agreements. It is recommended that the HTS# be requested from the foreign shipper, supplier, manufacturer, collaborator, or vendor shipping the item to you including donations. The number should be vetted to make sure it is correct to avoid penalties and fines. An HTS # looks like this: 3215.11.9010.

The Harmonized Tariff Schedule can be found here: https://hts.usitc.gov/

How much does it cost to ship internationally? What is "landed cost"?

Landed cost is the sum of expenses associated with shipping an item and it is typically associated with international shipping expenses such as insurance, taxes, and fees.

To help you calculate this number, consider some of the main components of landed cost: purchase price, value of the item (donation) or cost of repair, freight forwarder costs, transportation, customs clearance fees, and insurance. Once you add up the cost per unit, carrier fees, taxes, tariffs, and duties—insurance and processing fees—you will have a better idea of the cost to import an item into the country of destination. Work with the foreign shipper, Procurement Office or manufacturer to negotiate the price you will actually pay after everything has been added into the purchase price or value of the item.

Formula:

Value + Shipping (cost to ship) + Customs (duties/tariffs) + Risk (insurance) + Overhead (bank fees, currency conversion, etc.) = Landed Cost

*Note – "Value" can be transaction value (price paid), cost of repairs, replacement value, donation value, etc.

Will the customs broker charge me a fee to clear my shipment through customs?

Yes, the customs broker will charge a fee for their services, this includes shipments that are duty free items or are of nominal value. Please check with the designated broker, freight forwarder, or Procurement Services to assist you in defining the charges and fees to clear your shipment through customs prior to placing your order or requesting a broker to clear you items through customs.

Please be aware that certain products have an extra tariff that is applied to the item. For instance, items from China have an additional %25 or 35% add-on tariff rate:

Calculation: (Value x Duty (HTS#)) + (Value x Penalty (Tariff 25%-35%)) = Total Duties & Tariffs paid

Example: ($1,000 x 2.5%) + ($1,000 x 25%) = $275 (Total Duties & Tariffs paid)

Items that were previously "Duty Free", based on the HTS#, now have an added tariff penalty.

*Note – "Value" can be transaction value (price paid), cost of repairs, replacement value, donation value, etc.

CHINA: Why are extra duties being applied?

A Section 301 investigation, by the Office of the United States Trade Representative (USTR), determined that China's acts, policies, and practices related to technology transfer, intellectual property, and innovation are unreasonable and discriminatory. Section 301 provides a statutory means by which the United States imposes trade sanctions on foreign countries that violate U.S. trade agreements or engage in acts that are "unjustifiable" or "unreasonable" and burden U.S. commerce.

The link provided below contains a list of HS codes (products) affected by Section 301.

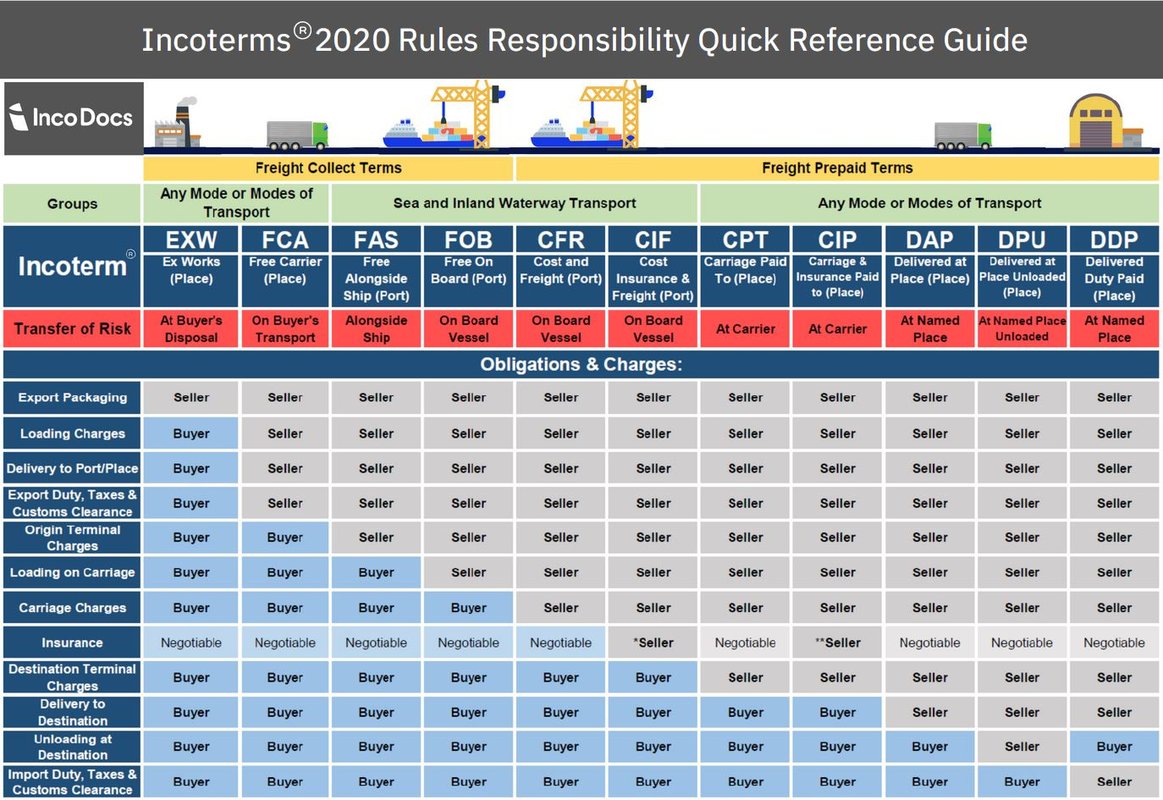

How do we determine who will pay the added costs? International Commercial Terms (INCOTERMS)

Incoterms, widely used terms of sale, are a set of 11 internationally recognized rules which define the responsibilities of sellers and buyers. Incoterms specify who is responsible for paying for and managing the shipment, insurance, documentation, customs clearance, and other logistical activities.

Here are some examples of Incoterms and how they work:

EXW - Ex-Works or Ex-Warehouse

"Ex Works" means that the seller delivers when it places the goods at the disposal of the buyer at the seller's premises or at another named place (i.e.,works, factory, warehouse, etc.). The seller does not need to load the goods on any collecting vehicle, nor does it need to clear the goods for export, where such clearance is applicable.

DPU - Delivered At Place Unloaded

"Delivered At Place Unloaded" means that the seller delivers when the goods, once unloaded, are placed at the disposal of the buyer at a named place of destination. The seller bears all risks involved in bringing the goods to, and unloading them at the named place of destination.

DDP - Delivered Duty Paid

"Delivered Duty Paid" means that the seller delivers the goods when the goods are placed at the disposal of the buyer, cleared for import on the arriving means of transport ready for unloading at the named place of destination. The seller bears all the costs and risks involved in bringing the goods to the place of destination and has an obligation to clear the goods not only for export but also for import, to pay any duty for both export and import and to carry out all customs formalities.

For more information, click on the infographic below for examples of all Incoterms and a depiction of elements such as transfer of risk , obligation, charges, etc.

For additional information, visit "Know Your Incoterms" on the U.S. International Trade Administration website by clicking here.

Please contact us to determine if your scientific instrument or apparatus is eligible for a U.S. duty-free waiver, or to determine if it can be imported under a Temporary Importation in Bond (TIB) duty-free.

For live non-human vertebrate animals and cephalopods, all shipments should be routed through the Office of Laboratory Animal Resources (OLAR). For embryos and germplasm, OLAR should also be included if the material will be used in vivo on campus (e.g., implanted into live animals).

OLAR instructions on importing/exporting and ordering animals can be found here: https://olar.caltech.edu/animals

- For imports of non-commercial animals and all non-rodent species, the orders should go through [email protected].

- For all non-vertebrate/cephalopod animals, the requests should be filtered to the IBC.

- For all human embryos/stem cells, the requests should be filtered to the IRB.

Visit: https://olar.caltech.edu/contact

- For general questions contact: [email protected]

- For exports contact: [email protected]

- For imports contact: [email protected]

If you are receiving biological or other materials under a materials transfer agreement (MTA), please submit the MTA to [email protected] for review and approval. For more information see https://ottcp.caltech.edu/patents-licensing/mtas and any questions email [email protected].